Macro topic 5.1 short-run fiscal and monetary policy – Embark on an exploration of macro topic 5.1: short-run fiscal and monetary policy. This fascinating topic delves into the intricate interplay between government spending, taxation, interest rates, and their profound impact on key economic variables. Prepare to unravel the complexities of fiscal and monetary policy, their effects on economic activity, and their potential for shaping economic outcomes.

This comprehensive guide will equip you with a thorough understanding of the different types of fiscal policy tools, including government spending and taxes, and their effects on economic activity. We will also delve into the role of the central bank in conducting monetary policy, examining the various monetary policy tools and their impact on economic outcomes.

Short-Run Fiscal and Monetary Policy

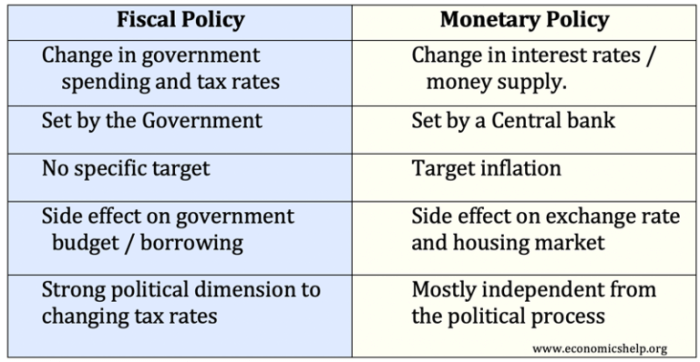

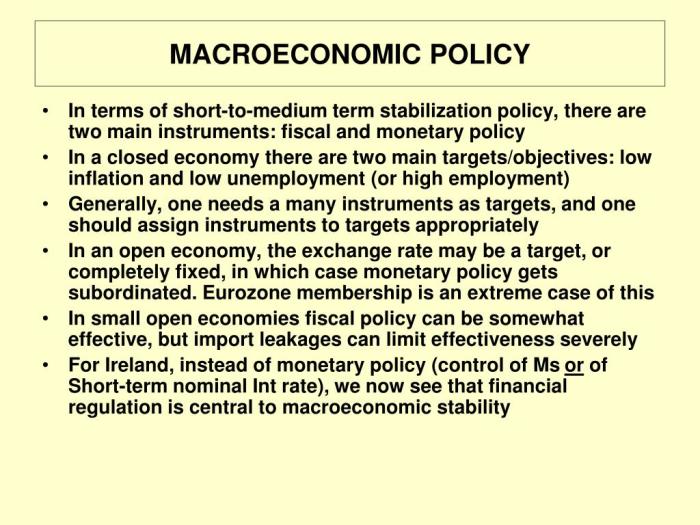

Fiscal policy and monetary policy are two key macroeconomic tools used by governments and central banks to manage the economy. Fiscal policy refers to the use of government spending and taxation to influence economic activity, while monetary policy refers to the use of interest rates and other monetary tools to control the money supply and credit conditions.

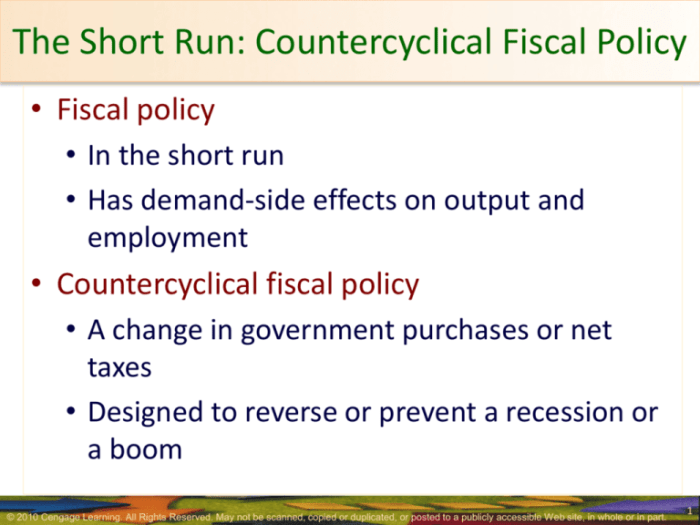

In the short run, fiscal and monetary policy can have significant effects on key economic variables such as GDP, inflation, and interest rates. Expansionary fiscal policy, which involves increasing government spending or cutting taxes, can stimulate economic activity and increase GDP.

However, it can also lead to higher inflation and interest rates.

Expansionary monetary policy, which involves lowering interest rates or increasing the money supply, can also stimulate economic activity and increase GDP. However, it can also lead to higher inflation.

Fiscal Policy

Fiscal policy is implemented by the government through its budget. The government can use various fiscal policy tools to influence economic activity, including:

- Government spending: Increasing government spending can stimulate economic activity by increasing aggregate demand.

- Taxes: Cutting taxes can increase disposable income and stimulate economic activity.

Expansionary fiscal policy is typically used during economic downturns to stimulate economic activity. Contractionary fiscal policy is typically used during periods of high inflation to reduce economic activity.

Monetary Policy

Monetary policy is implemented by the central bank. The central bank can use various monetary policy tools to influence economic activity, including:

- Open market operations: Buying and selling government securities to increase or decrease the money supply.

- Reserve requirements: The amount of money that banks are required to hold in reserve.

- Discount rate: The interest rate that the central bank charges banks for loans.

Expansionary monetary policy is typically used during economic downturns to stimulate economic activity. Contractionary monetary policy is typically used during periods of high inflation to reduce economic activity.

Interactions between Fiscal and Monetary Policy, Macro topic 5.1 short-run fiscal and monetary policy

Fiscal and monetary policy can interact with each other in a number of ways. For example, expansionary fiscal policy can lead to higher interest rates if the central bank does not accommodate the increased government borrowing by increasing the money supply.

Similarly, expansionary monetary policy can lead to higher inflation if the government does not reduce its spending or increase taxes to offset the increase in the money supply.

Coordination between fiscal and monetary policy is important to ensure that both policies are working towards the same economic goals.

Applications of Fiscal and Monetary Policy

Fiscal and monetary policy can be used to achieve a variety of economic goals, including:

- Full employment: Fiscal and monetary policy can be used to stimulate economic activity and reduce unemployment.

- Price stability: Fiscal and monetary policy can be used to control inflation and maintain price stability.

- Economic growth: Fiscal and monetary policy can be used to promote economic growth and increase productivity.

Fiscal and monetary policy have been used to address a variety of economic crises, including recessions and depressions.

FAQ Explained: Macro Topic 5.1 Short-run Fiscal And Monetary Policy

What are the main types of fiscal policy tools?

The main types of fiscal policy tools include government spending and taxes.

How does expansionary fiscal policy affect economic activity?

Expansionary fiscal policy, which involves increasing government spending or cutting taxes, can stimulate economic activity by increasing aggregate demand.

What is the role of the central bank in conducting monetary policy?

The central bank plays a crucial role in conducting monetary policy by controlling the money supply and interest rates.